how to check unemployment tax refund reddit

Is there a way to check on this. If you see a 0.

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest

When you contact the IRS be sure.

. How do I check my pending tax refund. How long it normally takes to receive a refund. Up to 3 weeks.

Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. This is the fourth round of refunds related to the unemployment compensation. Find out how you can obtain your.

If you havent opened an account with the IRS this will take some time as youll have. View Refund Demand Status Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. Heres how to check your tax transcript online.

Access your 2020 tax account transcript and look for the adjustment. You can do this by calling the IRS helpline or by visiting the IRS website. Up to 3 months.

And then the first refund check including. How do I check my pending tax refund. To check the status of your ERTC refund you will need to contact the IRS.

Visit IRSgov and log in to your account. Httpswwwirsgovindividualsget-transcript I checked my transcript and have. Form 1099G tax information is available for up to five years through UI Online.

If an adjustment was made to your Form 1099G it will not be available online. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. IRS sending unemployment tax refund checks For most states you will receive Form 1099-G in the mail from your state unemployment office.

Some tax returns need extra review for accuracy completeness and to protect taxpayers from fraud. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next.

If You Don T Get Form 1099 Is It Taxable Will Irs Know Hint If A Tree Falls In The Forest

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Here S Who Should Consider Filing A Tax Extension And How To Do It

Expert Explains Why You Should File Taxes Early What To Do With Your Refund This Year Wkrc

2020 Taxes How To Check The Status Of Your Refund Fortune

Irs Some May See Smaller Refunds Or None At All This Tax Season Keye

Confirmed Direct Deposits Unemployment Tax Break R Irs

Unemployment Tax Refund Question R Irs

Doordash 1099 Taxes And Write Offs Stride Blog

Unemployment Tax Break Recipients Could Get As Much As 5k Extra Khou Com

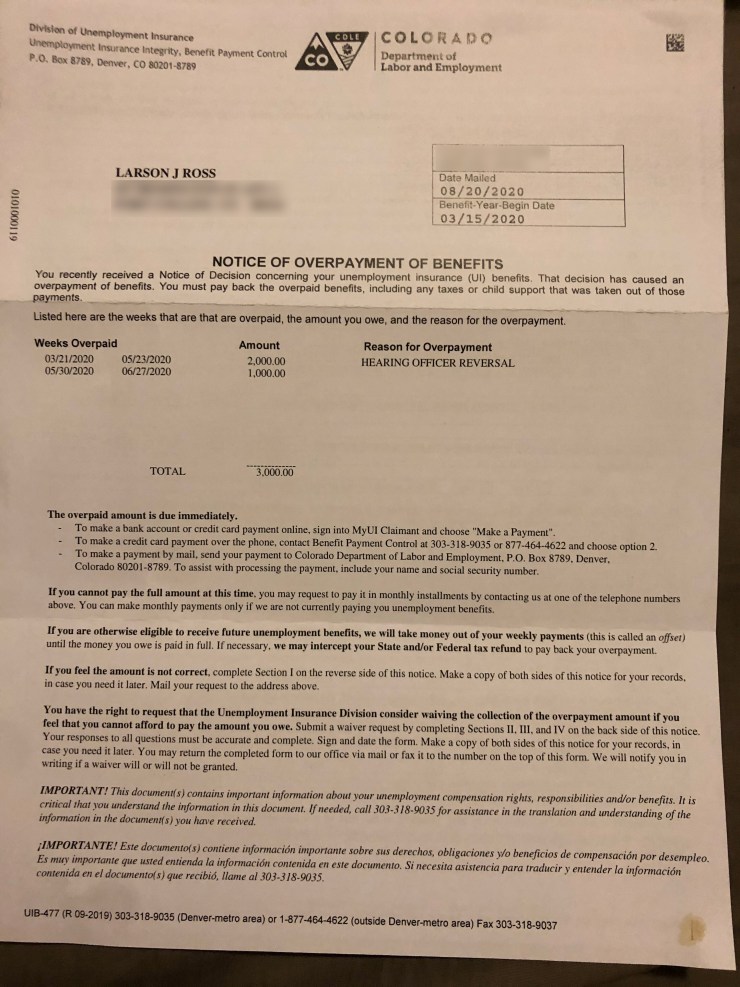

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

Need Cash Fast Ask Reddit The Atlantic

The 14 Cash App Scams You Didn T Know About Until Now Aura

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Where Is My Unemployment Tax Refund R Irs

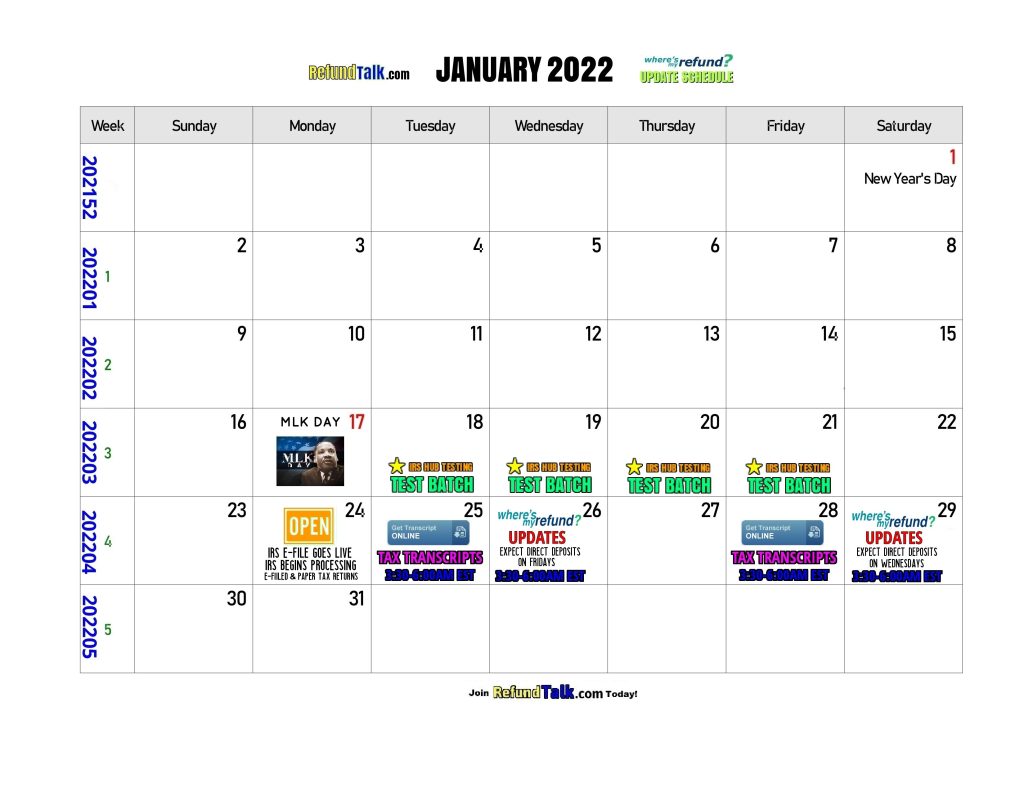

Tax Refund Updates Calendar Where S My Refund Tax News Information

Unemployment Tax Break Hoh 3 Dependents Taxes Were Not Withheld During Unemployment Had This Date Of June 14th Pop Up On May 28th Then It Disappeared And Went Back To As Of